Country Ranking Model - August 2024

Source: MSCI

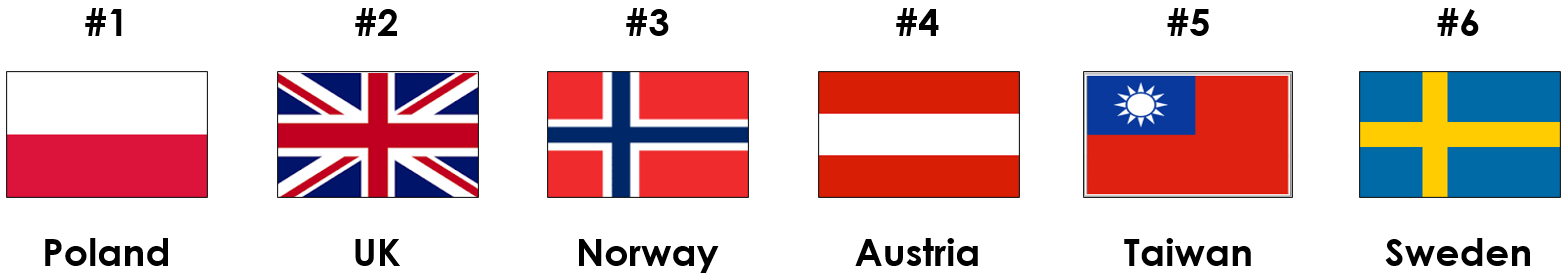

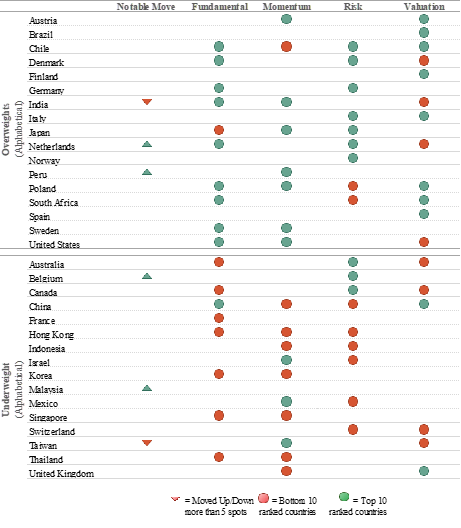

August Country Rankings

Poland (#1): Poland remains in top spot overall this month with 7th-ranked fundamentals, 9th-ranked momentum, 25th-ranked risk and 1st-ranked valuations. Poland recorded the EU’s largest annual and quarterly GDP growth in the second quarter of 2024. In annual terms, Poland’s economy grew 4%, ahead of high flying Cyprus (3.7%) and Spain (2.9%) and well ahead of the EU as a whole, which grew by 0.8%. In contrast, the EU’s largest economy, Germany, shrunk by -0.1%. Along with these strong fundamental tailwinds, Poland’s cheap valuations continue to propel the country to the top of the rankings. Poland has the lowest PEG ratio in our universe for example.

UK (#2): The UK moves into second place overall this month with 13th-ranked fundamentals, 10th-ranked momentum, 6th-ranked risk and 10th-ranked valuations. The country has maintained a steady pace of recovery from last year’s recession, putting new Prime Minister Keir Starmer on a strong economic footing as he looks to boost growth and repair public finances. GDP rose 0.6% in 2Q after an 0.7% gain in the first three months of the year, reflecting strength in government spending and the services sector. Britain is comfortably outgrowing other major European economies.

Norway (#3): Norway rounds out the top three this month with 14th-ranked fundamentals, 20th-ranked momentum, 8th-ranked valuations and an impressive 2nd place ranking in terms of risk. Norway’s low risk is driven by a stable political system, a decrease in semi standard deviation and a highly competitive Krone. Relative to the All-Country World Index, Norway’s equity market is concentrated in the energy sector. Equinor, the majority state-owned oil, gas and renewable energy provider is the largest company in the country by market cap

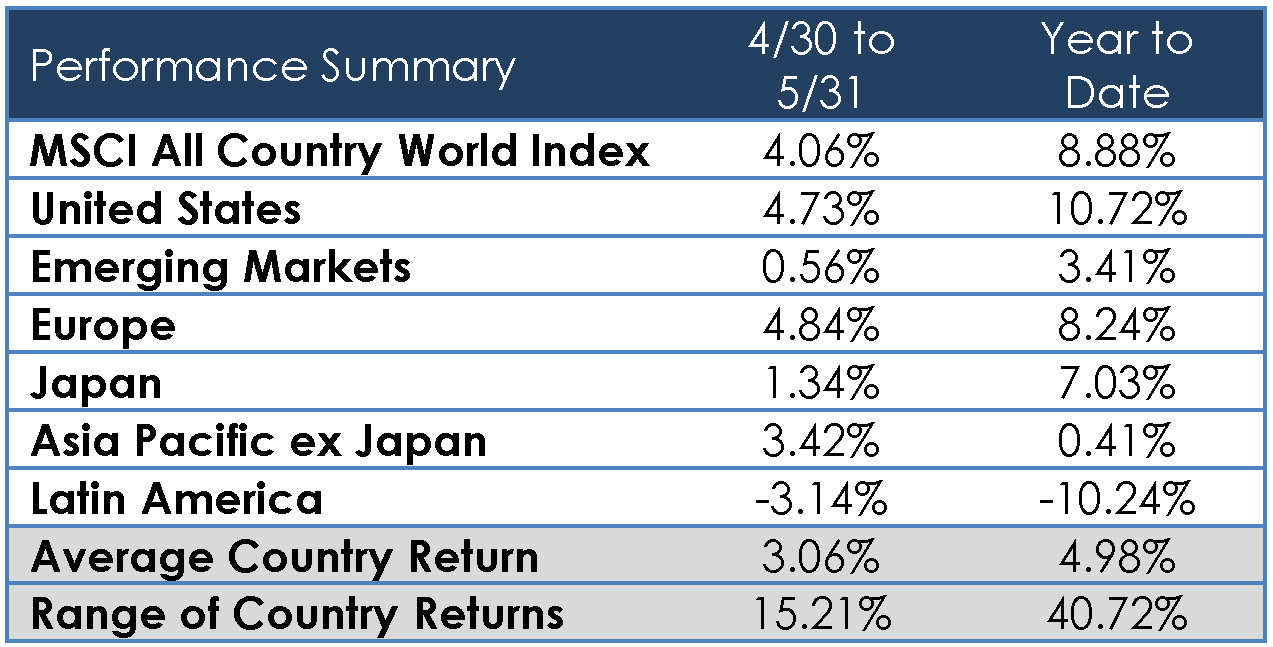

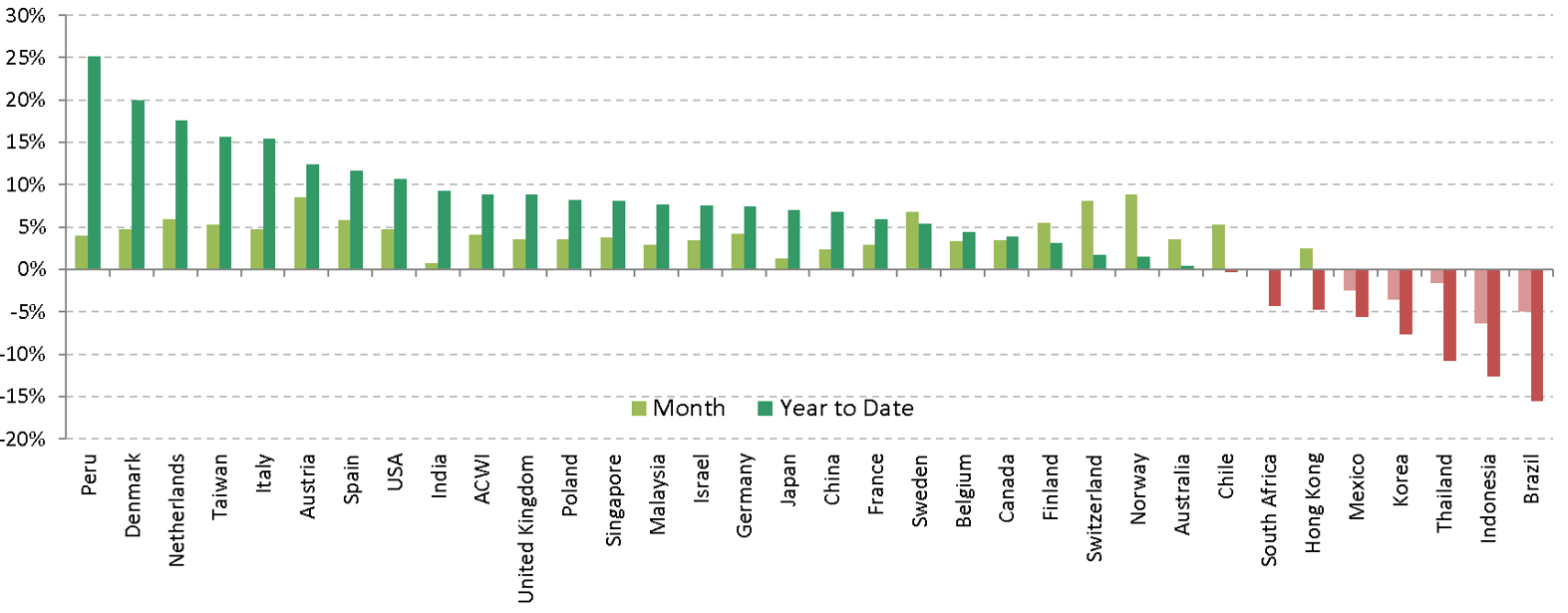

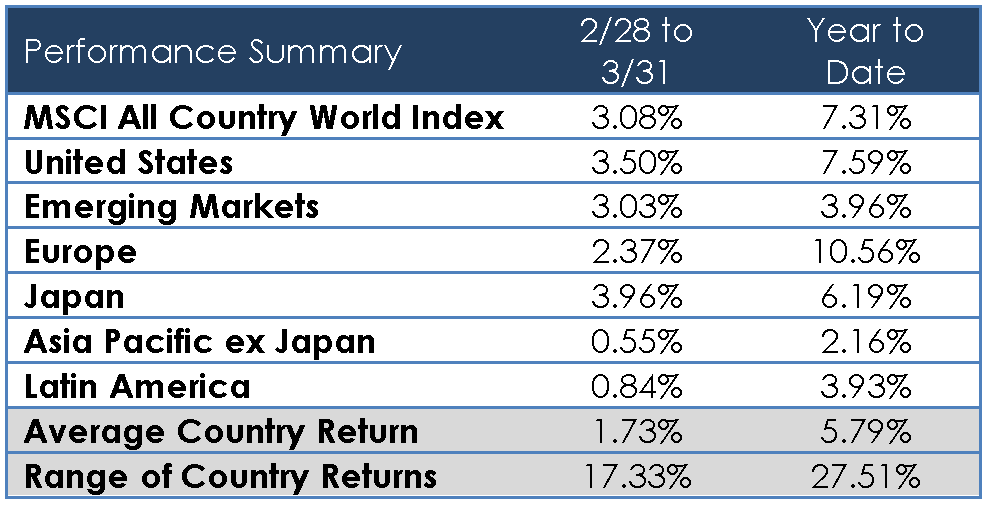

Country Performance:

Data as of 7.31.2024

Source: MSCI

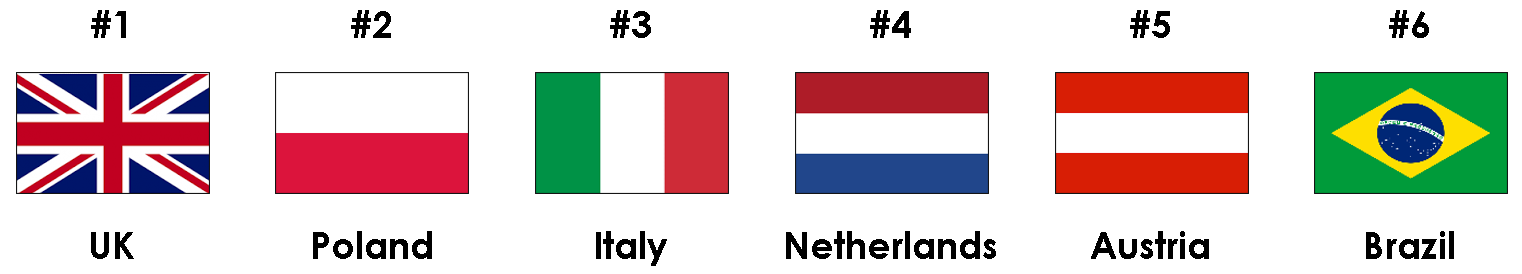

Country Ranking Model

As of 7.31.2024

Source: Accuvest Global Advisors

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.