Country Ranking Model - June 2024

Source: MSCI

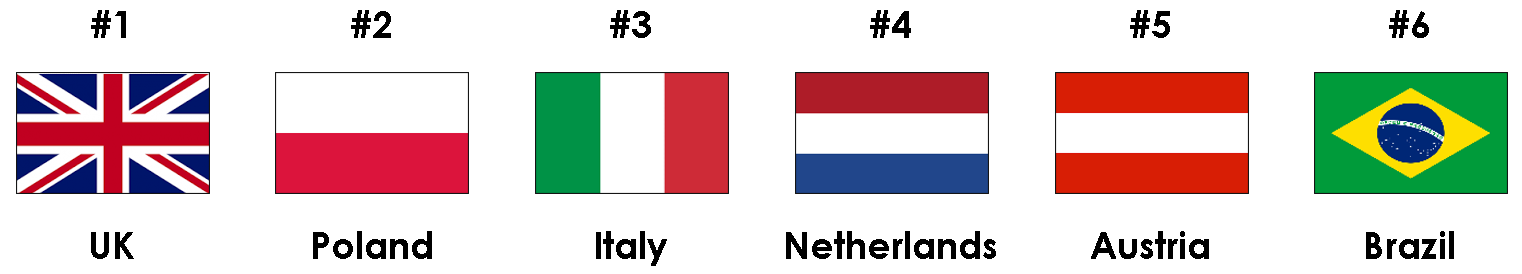

June Country Rankings

Country Spotlight: United Kingdom

It’s been a long time since UK stocks were in favor. Chronically low productivity growth, aging demographics and high public debt levels have dragged on the UK’s economy for the better part of a decade, with the 2016 Brexit referendum casting a long shadow of uncertainty that led many businesses to rethink or delay investment. In fact, real business investment in the UK still has not recovered to 2016 levels, a stark contrast to the double digit percentage increases in other G7 economies. Similarly, UK goods trade has underperformed other advanced economies by roughly 15% since the referendum. The country has also suffered from some of the highest post-pandemic inflation in developed markets, peaking at 11.1% in October of 2022. Economic malaise has gone hand in hand with political instability, with Liz Truss’ high profile, short-lived stint as prime minister coinciding with the pound falling to $1.03 in late September 2022 - an all-time low against the US dollar.

Indeed, in October of 2022 the UK was languishing in 30th place out of 33 countries in our country ranking model. Fortunately, there is strong evidence of a turnaround. Driven by improvements in fundamentals and momentum, the UK has risen over 10 places this month, and now ranks 1st overall, with 9th ranked fundamentals, 6th ranked momentum, 7th ranked risk and 8th ranked valuations.

Britain's economy grew 0.6% in the first quarter of 2024, the most in nearly three years, ending the shallow recession it entered in the second half of last year. Aditionally, the UK Manufacturing PMI rose to 51.3 and the Services PMI held firm at 52.9 in May, both above the 50 level that indicates expansion. Mirroring these positive developments, the long-term sales per share growth trend for UK businesses improved.

With CPI inflation dropping to 2.3% in April (thanks to a 12% drop in household energy bills) and core inflation declining to 3.9%, market participants appear to have confidence that disinflation will continue and estimate that the first interest rate cuts by the Bank of England will come in August of this year. With rate cuts on the horizon, money is flowing into UK assets. While the All Country World Index was down -3.3% in April, the MSCI UK Index was up 1.9%, and remains in a solid technical uptrend, returning 3.6% in the month of May.

Even the UK’s risk factor score has improved this month with a decrease in the credit default swap spread, and at the same time, UK valuations have held steady at a solid 8th ranking in our model. With an earnings yield of 8.2% and a price/book ratio of 1.8, the UK has some of the cheapest valuations around, especially compared to other developed markets.

With the economy showing signs of life, inflation on the decline, and investor sentiment turning positive, our multi-factor analysis suggests that British equities are entering a long-awaited revival.

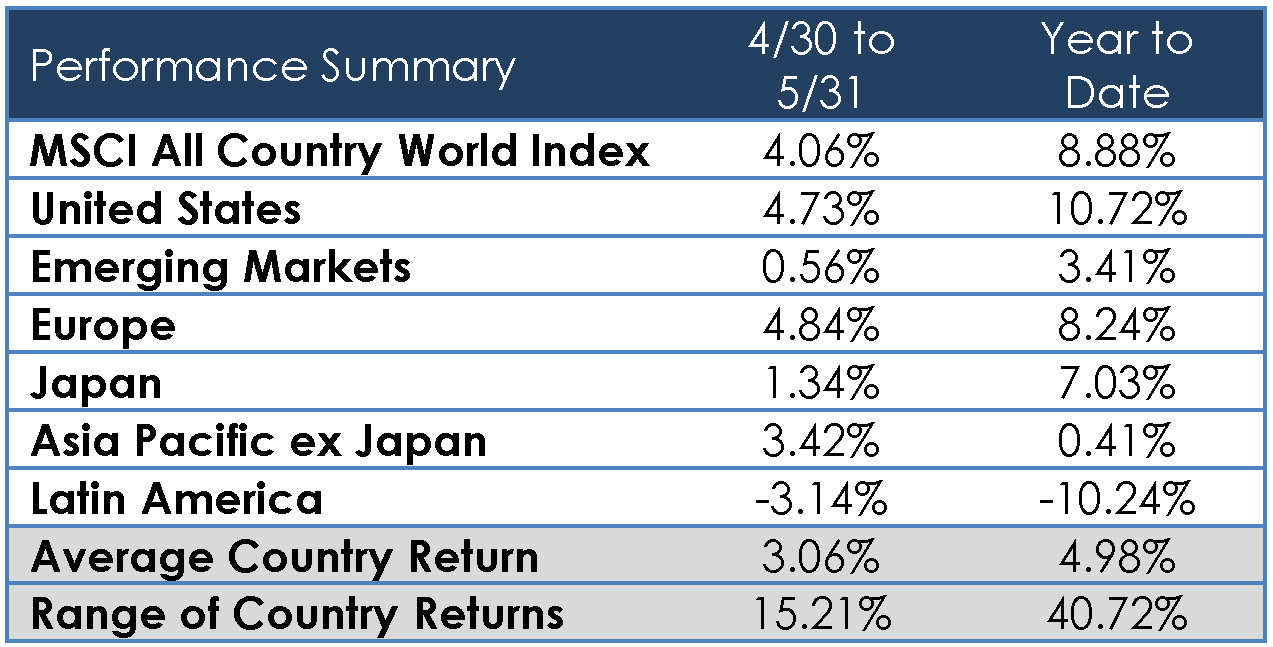

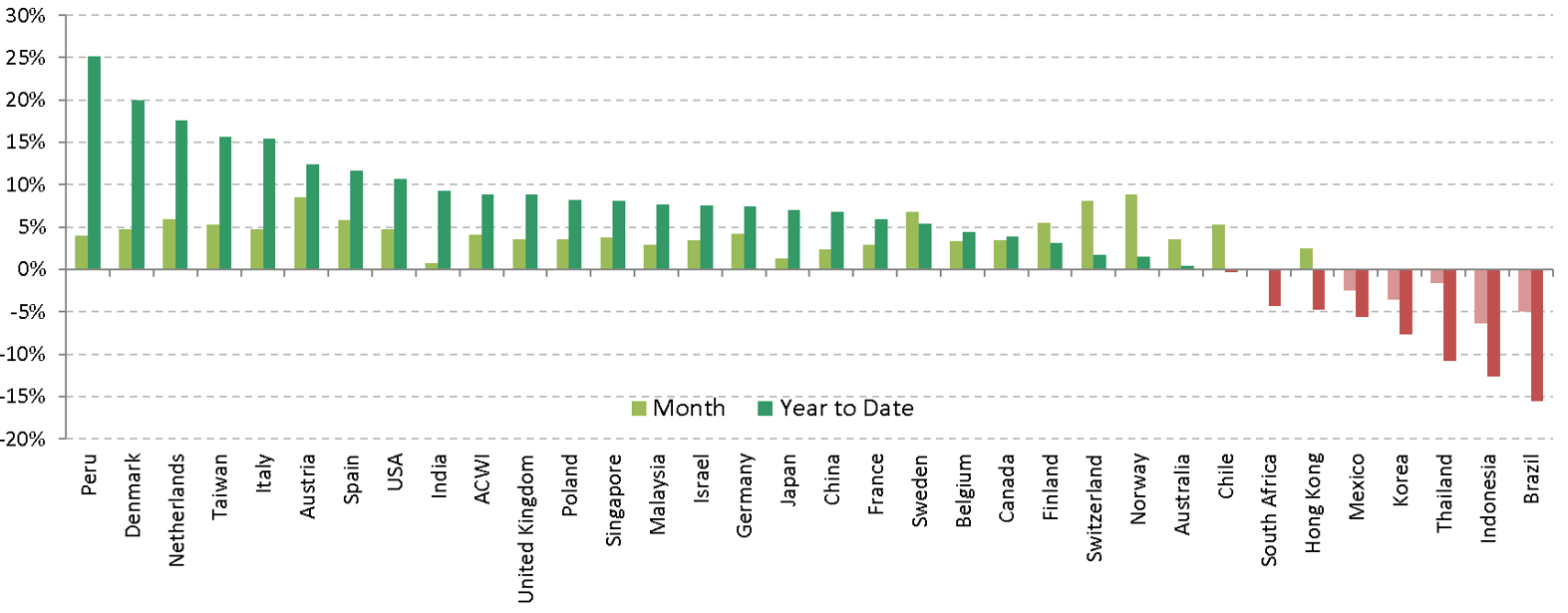

Country Performance:

Data as of 5.31.2024

Source: MSCI

Country Ranking Model

As of 5.31.2024

Source: Accuvest Global Advisors

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.