Country Ranking Model - April 2023

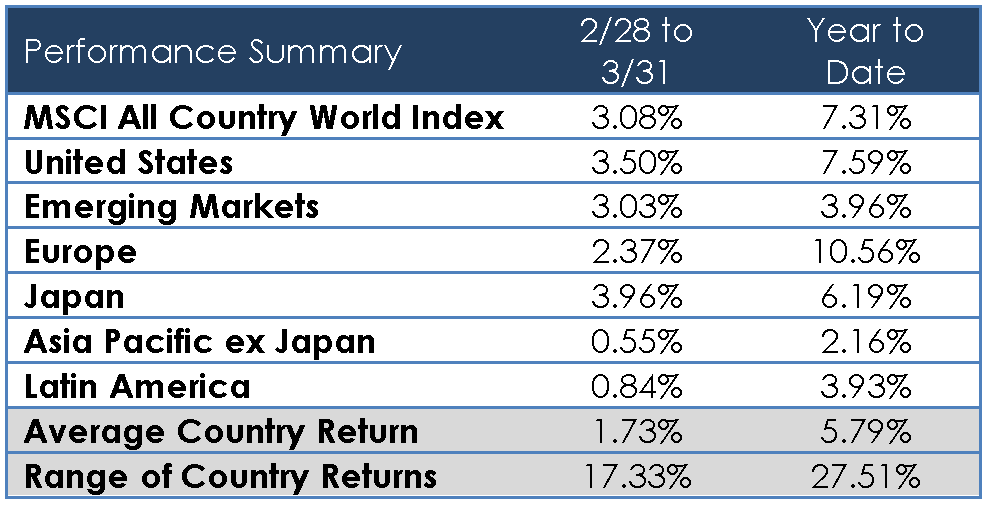

Source: MSCI

For the first time in a long time, Southern Europe is well represented at the top of our rankings, with Italy and Spain ranked first and second respectively. Post the 2011 Euro-zone debt crisis, these countries have been able to navigate the pitfalls inherent to the single-currency monetary union via compliance with EU fiscal rules and an absence of severe macroeconomic imbalances. This has become evident considering that in the midst of the ECB’s interest rate hiking cycle, fear of potential Euro-Zone fragmentation has been virtually non-existent. The ECB’s creation of the Transmission Protection Instrument (TPI), a sovereign bond purchasing scheme designed to be activated during times of market stress, has served to further support confidence.

Now that energy prices have declined and Russia-Ukraine concerns have subsided, investors are finally warming up to the idea that Europe, with its cheap valuations, strong earnings growth and an undervalued currency, warrants increased exposure in portfolios.

European apparel and luxury brands have been big winners this quarter as the consumer continues to spend and China’s reopening supports sales. Italy has been a big beneficiary with companies such as Ferrari up 26.5% and Moncler up 28%. Similarly, Spain’s fashion giant INDITEX returned over 24%. France, the ultimate luxury goods destination, is currently ranked second in terms of Momentum on the back of LVMH and Hermes up 27% and 31% respectively.

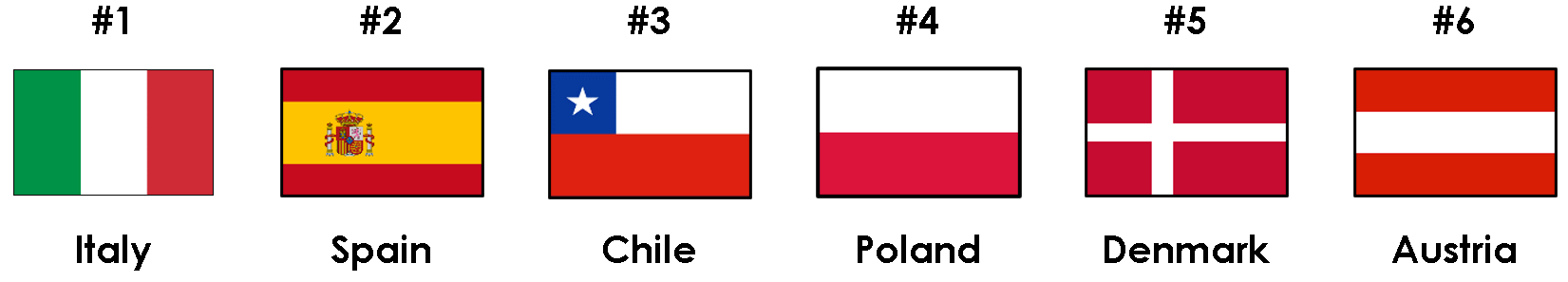

April Country Rankings

Italy (#1): Italy remains in first place overall with excellent Momentum (ranked 4th), attractive Valuations (6th), strong Fundamentals (9th) and relatively low Risk (17th).

Spain (#2): Spain has risen five places into second place this month with excellent price momentum and strong technicals. Spain’s real GDP growth in 2022 was significantly greater than the Euro Area average, growing by 5.5% compared to 3.5%. We see this trend continuing, as evidenced by the IMF increasing Spain’s growth forecasts to 1.5% in 2023 and 2.0% in 2024, much greater than the Euro-Area projections of 1.3% in 2023 and 1.4% in 2024.

Chile (#3): Chile has re-entered the top 3 this month owing to its very attractive fundamentals (8th), momentum (6th) and number one ranked valuations. For many months, Chile’s valuations have registered near the top of the universe across a wide range of metrics including earnings yield, PEG ratio and P/B. Chile’s risk is what is holding the country back (ranked 29th) as it has, among other things, a relatively overvalued currency and high downside volatility.

Country Performance

Data as of 3.31.2023

Source: MSCI

Country Ranking Model

As of 3.31.2023

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.