Country Ranking Model - February 2023

Source: MSCI

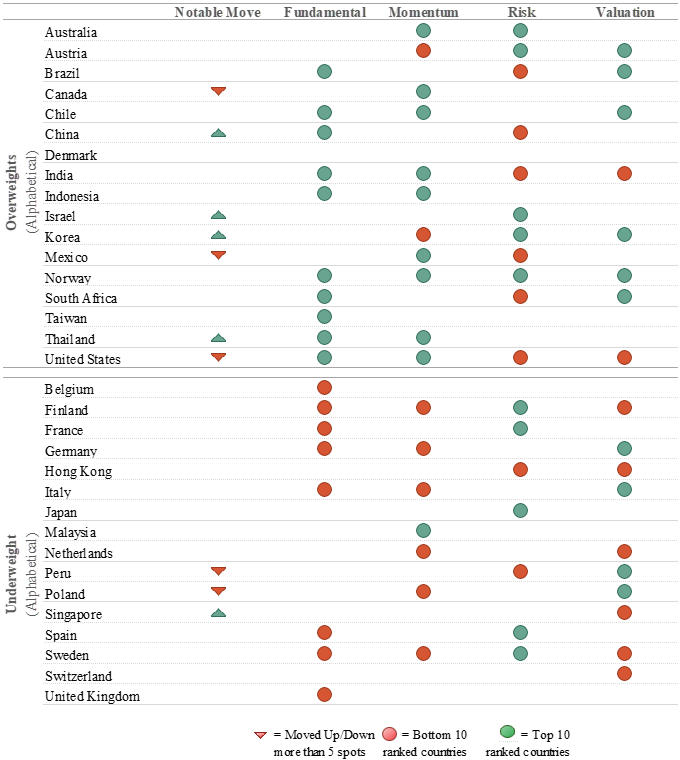

There were many notable moves in the rankings this month. For example, the United States has fallen to #32 out of the 33 countries in our universe as US leading economic indicators such as PMI have deteriorated, US equities have underperformed international equities recently, CDS spreads have widened, and the US market remains very expensive. In contrast, many European countries have risen in the rankings as the Euro has appreciated and the dire forecasts for a European recession may have been overstated. This is evidenced by the fact that Italy, Austria, Poland, France, Spain, Germany, Netherlands, and Switzerland all rose, on average, 6.75 spots this month.

February Country Rankings

Italy (#1): Moving into first place this month is Italy. Since the dust settled on its lastest political crisis and a clear majority was formed in parliament in October of 2022, Italy has significantly outperformed the global benchmark. Italy’s momentum ranking has now risen to 7th. Its fundamentals, risk and valuations are also strong and the country is enjoying improving CDS spreads and one of the highest growth to P/E ratios in our universe.

Norway (#2): Norway has fallen from first place into second place due to poor technical attributes and poor short & medium-term performance. January saw Norway return -2.45%, the second worse performer in our universe for the month after India (-2.99%). Nevertheless, the country still has very strong fundamentals (ranked 5th), risk (ranked 2nd), and valuations (ranked 6th).

Austria (#3): Rising 10 places is Austria on the back of improved fundamentals and momentum. Austria’s valuation also stands out with very attractive earnings yields and price to book. The country has weathered the energy crisis well. Prior to Russia’s invasion of Ukraine in February 2022, Austria imported 80 percent of its gas from Russia. By October 2022, Russia accounted for just 23 percent of Austria's gas imports.

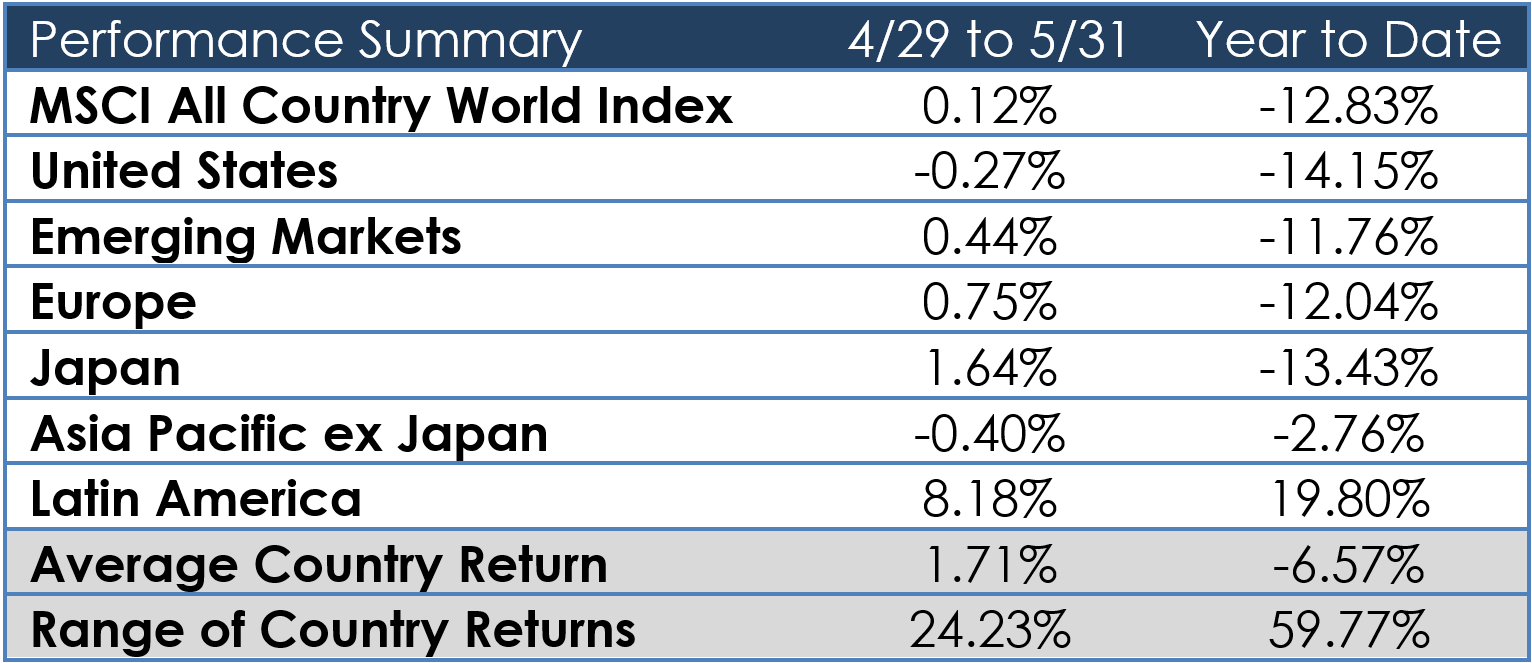

Country Performance

Data as of 1.31.2023

Source: MSCI

Country Ranking Model

As of 1.31.2023

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.