One of the great things about our business is that we get to talk to advisors of all shapes and sizes, all across the US and beyond. For the past five years, most have not wanted to discuss International (non-US and Emerging Markets) investing.

After all, most individual investors, pensions and nonprofits are less comfortable with international investing because they feel less informed about what is going on with economies and companies outside the US. And of course, investors who had non-US exposure during that time period had good reason to question what was going on. From 2013 to 2015, EM underperformed the US by over 65%.

I still have a vivid memory of the conversations we had during those three years…all about the benefits of global diversification…most of which fell on deaf ears at that point. And advisors, who were having the same conversations with their clients, just had to pull the plug on their EM exposure.

So going in to 2017, most investors had very heavy US allocations. If it wasn’t broke, why did they need to fix it? In addition, there was a very strong sentiment on the buy side (and sell side) that the US Dollar was going to strengthen, which bolstered the case for maintaining a significant US overweight.

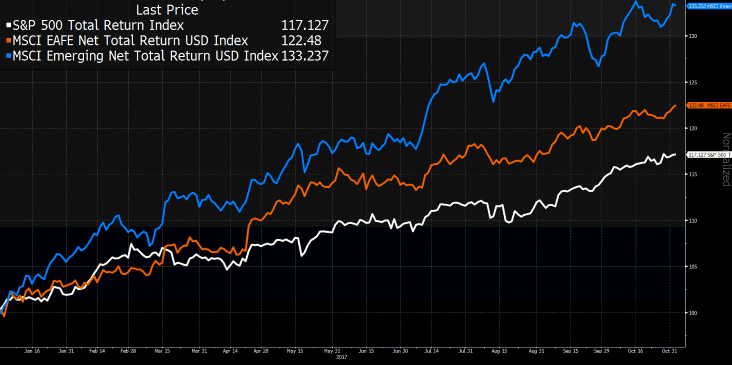

But, as we have seen in the past, strong relative returns create interest in an asset class. In the 1st quarter of 2017, the MSCI Emerging Markets index (EM) was up 11.4%, the MSCI EAFE index (EAFE) was up 7.25%, and the MSCI USA (US) index was up 6.1%. Advisors took notice, and began to “watch” the international markets more closely.

At the end of the 2nd quarter, EM was up 18.4%, EAFE was up 13.8%, and the US was up 9.2%. Those are great returns for a 6 month period in any market, and the relative return was actually enough for one large brokerage firm to close their EM overweight and take profits. But now advisors were really showing interest, and we were having lots of conversations about what the future held for overseas markets. Some took action, and others took a more wait and see attitude. Now, through 10/31/17, EM 32.3%, EAFE is up 21.8%, and the US is up 16.5%.

Source: Bloomberg. Data as of 12.31.16-10.31.207

So now the question we are getting is…have I missed the opportunity in international, and specifically in EM? You can probably guess what our answer is to that. It is an emphatic no! International investing still makes a lot of sense in the current environment, even with the huge outperformance this year versus the US. There are 3 reasons we think international markets still make sense:

1) On a variety of measures, EM and EAFE are cheap relative to the US.

2) Historically, the cycles of outperformance of Developed International vs. US stocks tend to last about 4 years, adding about 80% of outperformance. We are less than 1 year in to the current cycle.

3) Growth is stronger outside the US. Yes, it is true that GDP growth does not correlate to stock market performance. We prefer to look at leading indicator (LEI) growth. According the OECD, as of 10/2017, the vast majority of EM countries are showing stronger LEI growth (average .15%) than the developed and G7 countries (0.02%).

Are there risks out there to global investing? Absolutely. Are there things that are unforeseen that could cause markets to go down significantly? No doubt. But the question here is: Is it too late to get involved in International and emerging markets? And we think the balance of the evidence says no. There’s still time to get involved.