Key Points

The luxury home furnishings industry is highly fragmented & without a dominant brand.

Creative thinkers and visionaries are always under-estimated, which offers opportunities.

RH is the most exciting luxury brand in the current market and very few investors own the stock.

The luxury home furnishings industry is highly fragmented but there’s a Mega Brand coming

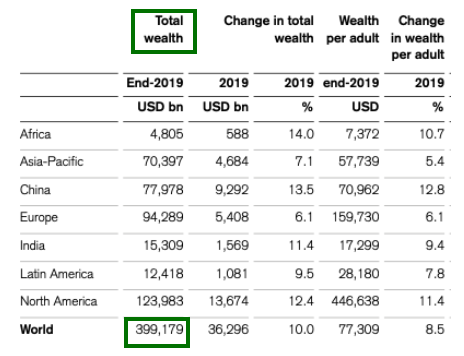

As a follow-up to my last post on the massive investment opportunity in leading luxury goods brands, I wanted to drill down into a particular category within the luxury goods industry. If you have ever been interested in upgrading your home or second home with luxury home furnishings, you likely have experienced frustration & a customer shopping experience filled with friction. Here’s what I mean. Let’s say you have a mountain house in Tahoe. You may or may not have strong design acumen, you may not know what your personal style is, and you absolutely don’t have a store in Tahoe that can help you solve these problems. It’s certainly not easy to find a store that will allow you to touch and feel all the pieces you may need or that has experienced designers willing to spend time with you to create the amazing space you have in your head. Now compound this problem across the globe and you have a real opportunity to delight global consumers. How big is the opportunity to serve global wealth? Boston Consulting Group (BCG) highlights in a recent report that total wealth – financial assets and real assets minus liabilities – rose by 7.2% in North America to $136 trillion; by 9.5% to nearly $117 trillion in Asia ex-Japan; and by 4.1% in Western Europe to $103 trillion in 2020. BCG estimates total global wealth to be roughly $431 trillion in 2020. That’s a massive amount of wealth looking for the most relevant brands across important spending categories.

One would think there would be at least one global brand serving every important spending category that included luxury home furnishings. Sadly, the home furnishings industry is filled with small, local boutiques and mostly mass-market brands like Pottery Barn & Williams Sonoma in the U.S. Something else needed to be created to fill a major void in the industry. Enter RH (Restoration Hardware). If you think of RH as you did about the old Restoration Hardware, you’re completely missing the opportunity as a consumer and an investor.

Visionaries are always under-estimated

Human beings tend to cluster together, there’s perceived safety in numbers. True visionaries, however, are happier standing alone, are courageous and willing to make bold decisions. As an investor, I always look for companies that have differentiated products and services, a large and global addressable market opportunity and management teams that are willing to think differently than their peers. I’ve been investing for over 28-years, and I can tell you, finding true visionaries serving enormous & untapped opportunities is harder than it sounds. When you find these wonderfully rare opportunities, you seize them as an investor, and you don’t let the market shake you out of the positions just because there’s some short-term noise. If you do the work and stay committed as long as the thesis stays intact, some wildly attractive gains can accrue to your bottom line.

Fun fact: RH is one of the top performing consumer stocks of the past decade and most investors don’t even have this company on their radar yet. Since the IPO on November 2, 2012, at $24 per share, RH’s stock price appreciation has outperformed a majority of the most relevant brands through the end of their fiscal 2020. Those names include Apple, Amazon, Google, Facebook, Nike, Starbucks, LVMH, Home Depot, Hermès to name a few. Even more impressive is the company’s acumen at buying back stock at severely discounted prices. In likely the greatest capital allocation decision in history, RH bought back almost 50% of their stock under the $50 level by mid 2017. The stock is currently $681 as I write this post on Monday, June 21st.

RH is just getting started and the world is starting to notice

If you have never visited an RH Gallery, I urge you to do so quickly if you are an investor and/or in the market for an entirely updated luxury home goods experience. These galleries instantly become the centerpiece of each community, and many have rooftop decks and restaurants. RH is not just a luxury home furnishings brand, they are blurring the lines between luxury retail, hospitality and leisure. That’s never been done before, certainly not at scale. Even after multiple blow-out quarters, most of the analyst community still under-estimates the future potential and estimates and target prices are absurdly low. When the CEO says RH has the potential to become a $20 to $25 billion global brand, I suggest people take him at his word. Global expansions take time and always have some short-term hiccups, but I have no doubt the brand will achieve its stated goals. If you want more evidence of a strong fundamental story, Berkshire Hathaway owns about 8% of the company the last time I checked their filings.

The galleries are quite possibly the most effective marketing symbols for any brand I’ve ever seen. When you walk by, you can’t help but go inside and do some dreaming. RH is much more than a walk-through gallery, however. It’s a full-service interior design center where designers will help you create your dream home room by room. To help remove the friction with your spending, RH created a membership program which is enormously valuable to consumers. For a $100 annual fee, members get 25% off on all full-priced items, an additional 20% off on all sale items, complementary services with RH Interior Design, preferred financing with great terms and early access to clearance events. Below is a picture of RH Nashville, it’s truly the talk of the town.

RH products are presented across multiple collections, categories, and channels and their desirability and exclusivity has enabled RH to achieve industry leading revenues and margins. There’s RH Interiors, RH Modern, RH Beach House, RH Ski House, RH Outdoor, RH Rugs, RH Lighting, RH Linens, RH Baby & Child, RH Teen, and Waterworks. They currently have museum-like galleries in NY, Chicago, Boston, West Palm Beach, Greenwich, Tampa, West Hollywood, Los Angeles, Marin (Bay Area), Yountville (Napa Valley), Nashville, and Dallas with more to come in San Francisco, Oak Brook (suburb of Chicago), and Jacksonville. In total they have 70+ galleries in the U.S. and Canada with more coming across the globe starting next year with the opening of RH England, The Gallery at Aynhoe Park, a 73-acre historic estate designed in 1615 by Sir John Soane, arguably one of the most respected and celebrated architects of his time. RH even has private planes via RH1 and RH2 and RH3, a luxury yacht, is currently available in the Mediterranean and Caribbean. The RH Bath House & Spa in Aspen is also scheduled to open in the second half of 2022. RH is no ordinary luxury furnishings brand; they are constantly moving the goalposts and thinking much bigger. As a dedicated global brands investor, I can’t help but get swept up in the story & vision Gary Friedman and his team has.

Summary:

The luxury home furnishings industry needs a dominant global brand.

Dominating any category requires true vision and an outside the box approach.

RH has the visionary CEO, the differentiated strategy and the global opportunity to dominate the luxury home category. Blending retail, hospitality and leisure offers an economic moat worthy of the premium valuation RH is destined to achieve.

Disclosure:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.