Key Points

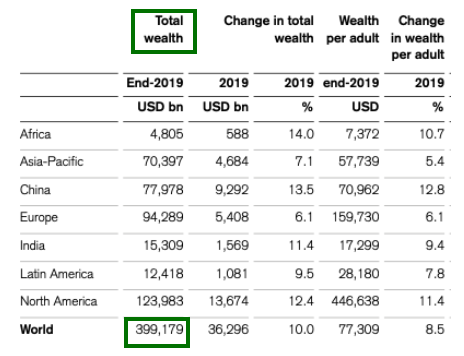

Total household wealth as of 2020 has grown at a blistering pace to roughly $399 trillion1.

Luxury goods consumption grew at a stable CAGR of 5.9% from 1996-2019.

The most relevant luxury goods brands have significant track records of outperformance

The wealth effect is real

Wealth around the world has never been higher. Between strong home price appreciation globally and a decade long equity market bull market, total household wealth is approximately $400 trillion. Yes, you heard that right, $400 trillion. Human beings are very predictable in many ways and their interest in consuming luxury goods and services has never been higher. With so much wealth around the globe, there are significant tailwinds present for the most relevant brands across all spending categories. No matter what income status a consumer has, the interest in spending a portion of one’s savings is always present. In the U.S. alone, the personal savings rate is now roughly 27%.

As a reminder, roughly 7% savings rates are normal over a long period of time so savings rates here are significantly elevated and likely to mean revert lower over the next 12-24 months. Given this savings data, I’m not sure if there’s any phenomenon with better tailwinds than the future of consumer spending. If nothing else, it will be a stable thematic and stable is something that we all enjoy when we are talking about our investments.

Luxury goods consumption is stable and predictable

With the new buy now, pay later finance category, consumers from all income levels can now access a broad category of luxury goods. The stable, long term growth rate of the luxury goods industry could be ready to accelerate. Normally, the most expensive luxury goods brands were available only to a sub segment of the population so this innovation in specialty finance has broad implications for consumer spending trends. Most consumers have aspirations outside of the normal spending they do and many of these luxury brands are where consumers tend to focus. The leading luxury goods brands should benefit disproportionately as consumers around the world reach for their favorite products from their favorite luxury brands. China, in particular, has shown a voracious appetite for luxury brands as the growing middle class across China and Asia continue to consume products across all spending categories. Chinese consumption of luxury goods is set to grow by 60% between 2018 and 2025 (McKinsey estimate), well above the growth rate of broad consumer spending generally.

Data source: Emles Advisors LLC.

The most relevant brands serving the luxury category have strong investment track records

If a spending category grows in a stable, predictable fashion it’s only logical the most relevant brands serving this theme should offer attractive investment returns, particularly when a brand is serving a global audience of consumers.

If a brand and its luxury goods appeals to kids through older adults, you get a perfect storm of revenue opportunities. That’s what I see currently for many of the leading luxury brands. Some might not seem like “luxury” products but luxury just means higher price points, higher quality merchandise and strong pricing power due to high brand love and loyalty. The image below highlights some of the most popular luxury goods brands and their 5-year returns versus the S&P 500 as of May 19, 2021 via Ycharts.

Source: Y Charts

For my current opinion on 3 of these great luxury brands, click the names of LVMH, Tesla or RH:

Louis Vuitton (LVMH): operates five luxury segments: fashion & leather goods, watches and jewelry, wines and spirits, perfumes and cosmetics, and selective retailing (Sephora & duty-free stores).

Hermes: a 180-year-old luxury company best known for its Birkin & Kelly bags. Also leather goods, clothes & accessories, silk & textiles, perfumes, watches and jewelry and home furnishings.

Tesla: as you know is the leading EV auto manufacturer by far. Their tech lead is enormous.

RH: if you haven’t been to a RH (Restoration Hardware) gallery or restaurant, I urge you to visit. They are building a global empire and becoming the LVMH of luxury home furnishings.

Ferrari: who doesn’t dream about owning a $350k luxury sports car! The company has software company margins in a low margin auto industry. Wealthy consumers all over the world beg to get on the waiting list for these amazing vehicles.

Apple: iPhone, iPad, Mac, earbuds, Apple TV, MacBook’s, their product lineup is endless and demand is insatiable.

Estee Lauder: the world leader in global prestige beauty with dominant market share in key categories like: skincare, makeup, fragrance, haircare with brands like Clinique, MAC, & Aveda.

Williams Sonoma: the pandemic has been very kind to all things home-related and they have become a very popular house of brands like: Williams Sonoma, Pottery Barn, Pottery Barn Kids & teens, and West Elm.

Kering: not a well-known brand in the U.S. but I’ll bet you are very familiar with many of the brands under their umbrella: Gucci, YSL, Bottega Veneta. A very popular brand in high-end apparel, particularly in Europe.

Lululemon: the heavily popular yoga and athleisure brand that’s become a global sensation. Last year in the middle of the pandemic they spent $500 million to buy home fitness company, Mirror so there’s a new way to connect fitness and apparel purchases.

Reality

Most investors have very little exposure to the important luxury goods brands. I think I have proven the opportunity is attractive and the performance history of the most relevant brands is robust. An investor can certainly gain exposure through a brands-dedicated investment and now, there’s an ETF that offers access in a very laser focused way. Our view has always been that every investor needs a consumer core equity holding and should consider satellite positions around the core that are tied to other large, predictable themes with strong growth characteristics. My personal goal is to educate, inform, entertain,and hopefully add value to your day by showing you ideas and investments you may not know exist.

Check out my recent conversation with Emles founder Gabriel Hammond who has a very interesting story as a serial entrepreneur.

Episode 10: Mega Brands – Interview with Luxury Goods ETF founder, Gabriel Hammond

Summary:

The luxury goods category is thriving as global wealth reaches all-time highs.

With the new buy now, pay later fintech options available to consumers, more luxury goods will become more reachable to the masses of global consumers.

This makes the thematic a wonderful allocation in portfolios through brands you aspire to owning.

Disclosure:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.