The Country Ranking Model

Data as of 3.31.2022

Source: MSCI

April Country Rankings

Chile (#1): Rising 8 spots into first place is Chile. Chile has benefited from the rise in global commodity prices as their economy is highly leveraged to copper and other commodity exports. Chile screens well across the board with strong Fundamentals, Momentum and Risk. Valuations in particular are very attractive, as evidenced by a Price to Book ratio of only 1.12.

Norway (#2): Norway remains in second place with 13th ranked fundamentals, 8th ranked momentum, 5th ranked risk and 10th ranked valuations.

Brazil (#3): Moving into third place is Brazil with very attractive fundamentals (ranked 2nd), Valuations (ranked 1st) and Momentum (ranked 6th). However, Brazil screens poorly across Risk metrics such as FX competitiveness and political risk. The country ranks 32nd out of 33 countries in Risk.

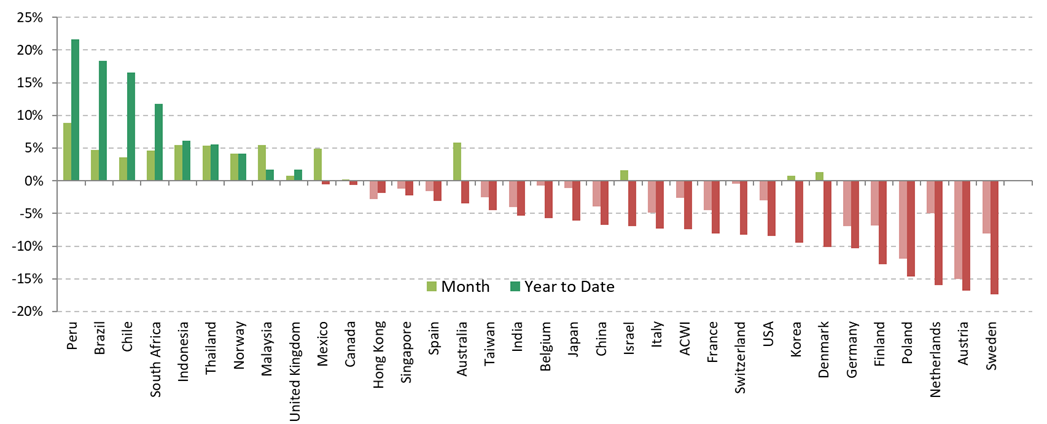

Country Performance

Data as of 3.31.2022

Source: MSCI

Country Ranking Model

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.