The Return of Inflation

In early 2020 COVID-19 cases were rising, job losses were mounting and the economy was shutting down. For investors and policymakers alike, deflation was a very real concern.

In response to this economic shock, governments around the world have provided record levels of fiscal and monetary stimulus. In the U.S., congress approved over $5 trillion in government spending and the Federal Reserve doubled the size of its balance sheet.

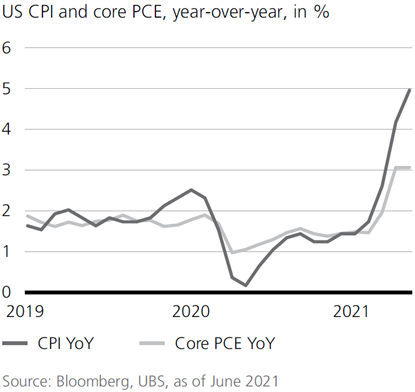

Fast forward to 2021 - with so much liquidity injected into the system and the economy recovering, inflation is now top of mind for investors and consumers. What a difference a year makes!

US CPI and core PCE, year-over-year, in %

Commodities – An Effective Inflation Hedge

For investors, inflation poses serious risks, but also offers interesting opportunities. While high inflation can erode real returns in fixed income, it can also deliver fundamental opportunities in other asset classes.

Commodities are one such opportunity.

Commodity prices are denominated in dollars, and therefore tend to rise with inflation. An allocation to commodities can provide portfolios with an effective hedge against inflation and dollar weakness.

Indeed, we have seen an incredible surge in commodities this year. At the time of writing, the S&P GSCI Index is up 30% YTD – easily the best performing asset class in 2021.

Where do we go from here?

The current debate among investors is whether there is more upside in commodities to be had. Some believe that we have entered the middle of the business cycle and economic growth will moderate and inflation will prove transitory. In this scenario, the outlook for commodities does not look particularly rosy. Others believe that the unprecedented government spending and still low interest rates will unleash a rapid Covid-19 recovery and extended economic expansion.

Here at Accuvest we are of the view that the “reflation trade” is not over. We continue to anticipate strong economic growth as people get back to work, accumulated household savings are spent, the Fed remains accommodative and fiscal policy remains supportive. Additionally, as global vaccination rates rise, the outlook for the global economy, particularly Europe and Emerging Markets, has improved.

We believe that the Federal Reserve would like inflation to prove persistent, not transitory. We expect the Fed to adapt their forward guidance and rhetoric to achieve this goal. As a result, we continue to anticipate inflation above 2% and recommend an inflation hedge, like commodities, for portfolios.

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.