Asset Allocation

After a difficult April, both equities and fixed income experienced a tepid rebound in May as the market continued to digest concerns over recession risk, sticky inflation and rising interest rates. Our portfolios were equal weight equities, underweight fixed income and overweight commodities. Commodities performed well and helped generate a net positive asset allocation effect for portfolios.

Security Selection

In equities, exposure to the US factor rotation strategy (FCTR) and the European financials value theme (EUFN) contributed to outperformance against the global equity benchmark. In Fixed Income, our active tilt towards short maturity bonds and a satellite allocation to senior floating rate loans contributed to underperformance against the longer maturity fixed income benchmark.

Detractors from Performance

Contributors to Performance

Short Maturity Bonds

Senior Floating Rate Loans

S&P 500

European Financials

US Factor Rotation

Commodities

Underweight

Overweight

Technology Sector

Asia Pacific Equities

Government Debt

Western Europe

Financial Sector

Short Term Corporate Debt

Strategic Allocation Rationale

Asset Allocation:

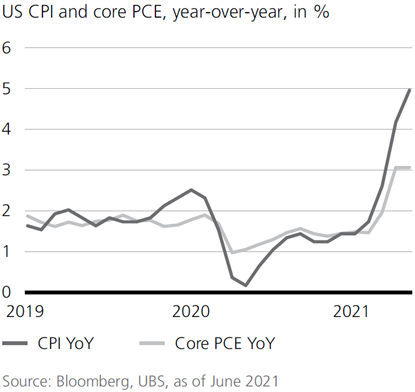

We view Equities and Alternative Strategies as strategically attractive relative to Fixed Income. With high inflation and a tightening Federal Reserve, we believe interest rates have further room to rise - which will weigh on income. Equities and commodities provide an effective hedge against inflation and geo-political uncertainty. We do not an anticipate a recession.

Equities:

We do not anticipate a recession, corporate profitability remains strong and the consumer's balance sheet is healthy. In the near-term we are opportunistic and in the medium-term we are bullish. In the near-term we are opportunistic and in the medium-term we are bullish. We are geographically diversified and are selective with our US exposures, favoring value over growth stocks.

Fixed Income:

After a historic rise year to date, we are bearish on interest rates in the near-term, while in the medium term we see the potential for a further rise. We continue to favor shorter maturities. We also favor high yield and emerging market debt due to very attractive yields. We are opportunistically adding to 2-to-4 year corporate bonds.

Alternatives:

With high inflation, rising rates and elevated geo-political uncertainty, we remain overweight commodities. We favor energy and agriculture. After an exceptional start to the year, we are prepared to react to inflection points in the asset class and will take profits when appropriate.

Portfolio Changes Since Last Month

Decreased

Increased

Cash Allocation

Senior Floating Rate Loans

Value & Quality Tilted US Equities

Held-to-Maturity 2026 Investment Grade Bonds

Held-to-Maturity 2023 High Yield Bonds

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.