2025 Outlook: Cautiously Optimistic

After two consecutive years of 20%+ returns from the S&P 500, we are heading into 2025 cautiously optimistic. Our Core-Satellite-Tactical (CST) separately managed account models are overweight equities and alternatives and underweight fixed income.

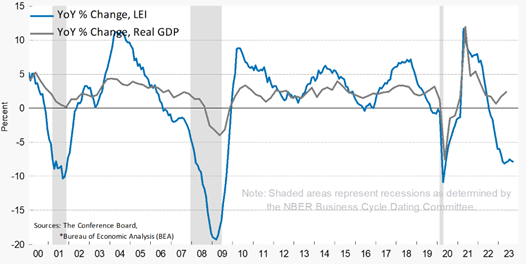

We are anticipating economic growth slowing back to trend (approximately 2%) in the US in 2025, with recession probability below historical averages. The US consumer is healthy, with solid retail sales, income growth and balance sheets. US corporations are looking particularly strong, with 14% estimated EPS growth, high CEO confidence and extremely tight high yield spreads. A deregulatory push from the incoming Trump administration also looks likely. We therefore believe that our moderate tactical overweight to equities can remain in place, coming at the expense of fixed income.

This is not to say that fixed income is an unattractive asset class - over 200 bps of positive real yield is on offer across the yield curve, something that hasn’t been seen since prior to 2008 - but with disinflation stalling and tariffs on the horizon, we are anticipating a higher “resting heartbeat” for inflation in 2025. This will likely prevent the FED from cutting rates at the short end of the curve as quickly as the market expects, and will put a floor under how far rates can retreat at the long end. We therefore prefer to overweight equities, letting us participate in the upside of economic growth and innovation. We also remain committed to a dedicated exposure to alternatives, with our current allocation consisting of Ethereum, Bitcoin, managed futures and gold. All four of these alternative assets have inflation-protection characteristics that have proven invaluable over the course of 2024, and we believe will continue to benefit us in 2025.

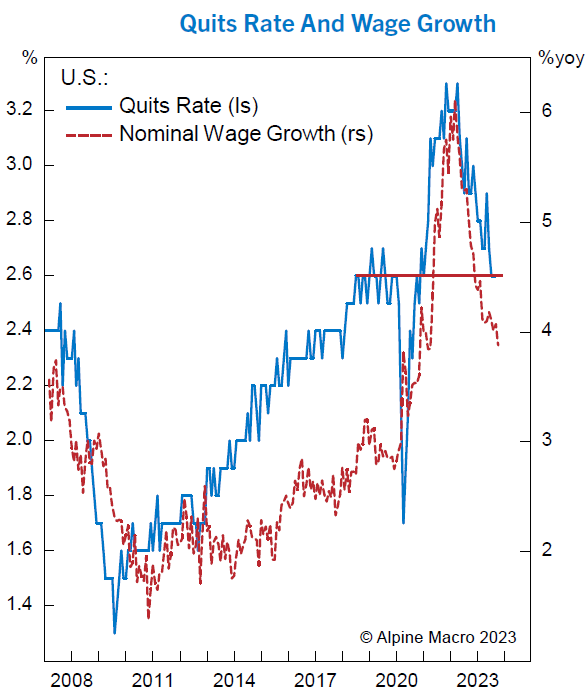

Within our equity allocation, we are expressing our tactical overweight to US, large cap growth stocks via QJUN, a First Trust 10% buffer ETF that tracks the Nasdaq 100 index. We prefer the mega cap names in the Nasdaq 100 index because they are capable of boosting their top line revenues through pricing power and idiosyncratic growth drivers, while simultaneously boosting earnings per share though economies of scale, profitability, strong balance sheets and share buybacks. The mega caps have invested heavily in scale and product innovation, particularly around AI, and we believe they can continue stable and strong growth independent of the economy. In contrast, we do not see sufficient broad-based economic growth to favor more economically-sensitive small-cap companies, or value stocks with higher operating leverage. A less accommodative FED that is forced to keep rates higher for longer due to stubbornly high inflation may also delay any broad-based, early-cycle type of economic surge. And with unemployment still at an impressively low 4.2% and immigration set to fall, there is not enough slack in the labor market to fuel additional economic growth. Similarly, without significant economic growth outside of the US, we fail to see a catalyst that would cause money to start flowing internationally and as such, we continue to remain overweight US, large cap growth.

Relative strength is a pre-requisite

We also prefer the mega cap growth names over other parts of the market because they continue to demonstrate strong momentum. Monitoring relative strength across asset classes and market segments is a key input to our risk management and portfolio construction processes. Growth vs value, small cap vs large cap, international vs US… these are examples of some of the factor trends that we analyze to pinpoint market leadership and relative strength. Momentum has been shown to persist for extended periods of time in financial markets, sometimes even longer than the fundamentals would justify. So, we prefer to wait for confirmation that money is flowing into unloved parts of the market before rotating portfolios in those directions. Value stocks and international stocks, for example, are two areas of the market that we would love to own, when the time is right. Value stocks haven’t been this cheap relative to growth stocks in the US for decades (Exhibit 1), similarly international stocks are at historic discounts relative to US stocks (Exhibit 2).

Exhibit 1:

Source: JP Morgan

Exhibit 2:

Source: JP Morgan

While buying stocks at cheap valuations bodes well for future long term expected returns, valuation is not a good short term timing indicator. These parts of the market can stay cheap for a very long time. And as such, we do not want to allocate portfolio risk towards these areas prematurely, without an investment catalyst or relative strength. As shown in the weekly trender charts below, value stocks continue to underperform growth stocks (Exhibit 3) and international stocks continue to underperform US stocks (Exhibit 4). Therefore, despite the attractive "price” of US value and international equities, we will wait for sufficient evidence that new investment is flowing into these market segments. While diversification remains a focus, we will require new trends before tilting portfolios away from current market leadership (US Large Cap Equities).

Exhibit 3:

Source: Bloomberg

Exhibit 4:

Source: Bloomberg

Downside protection (still) welcome

In addition to managing risk via trend analysis, we are managing downside risk in our equity portfolio by the types of vehicles that we own. 81% of the equities in our CST models are hedged using Buffer ETFs. Buffer ETFs are innovative exchange-traded funds that track the performance of an underlying index such as the S&P 500 or the Nasdaq 100 but provide investors with a predetermined level of downside protection (a “buffer”). Many buffer ETFs in our portfolios have 9% downside protection. This means that if, at the end of the outcome period (usually one year), the market is down 9%, the fund will be down 0% (flat). If the market is down 10%, the fund will only be down 1%. If the market is down 11%, the fund will only be down 2%. And so on. In exchange for this protection, the funds retain capital appreciation potential up to a predetermined level (the “cap”). Currently, 9% buffer ETFs are offering upside caps in the 15% range. To illustrate the concept of a “cap”, if the market is up 15% at the end of the outcome period, a fund with a 15% cap will also be up 15%. If the market is up 16%, the fund will only be up 15%. If the market is up 17%, the fund will only be up 15%. And so on. Historically, these types of defined outcome vehicles have only been available through certain bank and insurance products, often in the form of structured notes. These legacy products are opaque, illiquid, and come with punishingly high fees. They are also subject to the underlying credit risk of the issuer. In contrast, Buffer ETFs are daily liquid, transparent, tax-efficient, cost-efficient, and are not subject to counterparty risk. So, by accepting a limit on growth potential in the form of an upside cap, these ETFs create a built-in buffer against loss over a defined outcome period, usually one year, after which the ETF resets its exposure and buffer zone.

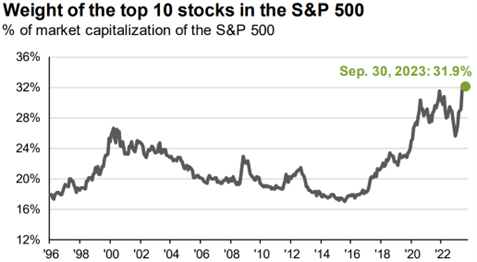

We have been holding these buffer ETFs in our portfolio for some time now. The protection that they provide helps us feel comfortable implementing our tactical overweight to equities. While we are willing to allocate towards market momentum and leadership, we respect the risks present in the market cap weighted indexes, namely high company concentration and relatively expensive valuations. These risks are particularly high in the US, where we are overweight. The top 10 largest stocks in the S&P 500 constitute 36.2% of total market cap at the index level. These same 10 stocks also have a weighted average P/E of 28.8x, which is considerably more expensive than the remaining 495 stocks’ P/E of 19.6x (and well above the S&P 500’s long run average of 16.6x).

Additionally, the S&P 500 has delivered breathtaking performance this year, with very few pullbacks. In fact, 2024 performance is in the top 95% of all S&P 500 calendar year observations since 1928 (Exhibit 5).

Exhibit 5:

Source: Goldman Sachs

Such strong performance suggests that the market has pulled forward some of the EPS growth and interest rate cuts anticipated in 2025 and the market may now be more vulnerable to earnings disappointments or a less accommodative Federal Reserve. In such an environment, we believe the buffer ETFs still make a lot of sense, they will give us downside protection in the event of a correction and allow us to stay invested in the market and earn what we believe will ultimately be healthy upside over the course of 2025.

For more information about our investment management and trustee support services, please visit our website at www.accuvest.com or contact marketing@accuvest.com

Disclosures: This information was produced by, and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold, or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets, or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and they may be significantly different than those shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.