Roughly 4 billion Millennials and Gen-Z globally offer massive tailwinds to certain brands.

Key Points

Demographics play a key role in identifying important consumer trends & themes.

Millennials and Gen-Z now make up a large portion of the global population.

The brands that are loved by this cohort have a multi-decade runway of growth ahead.

Demographics Matter.

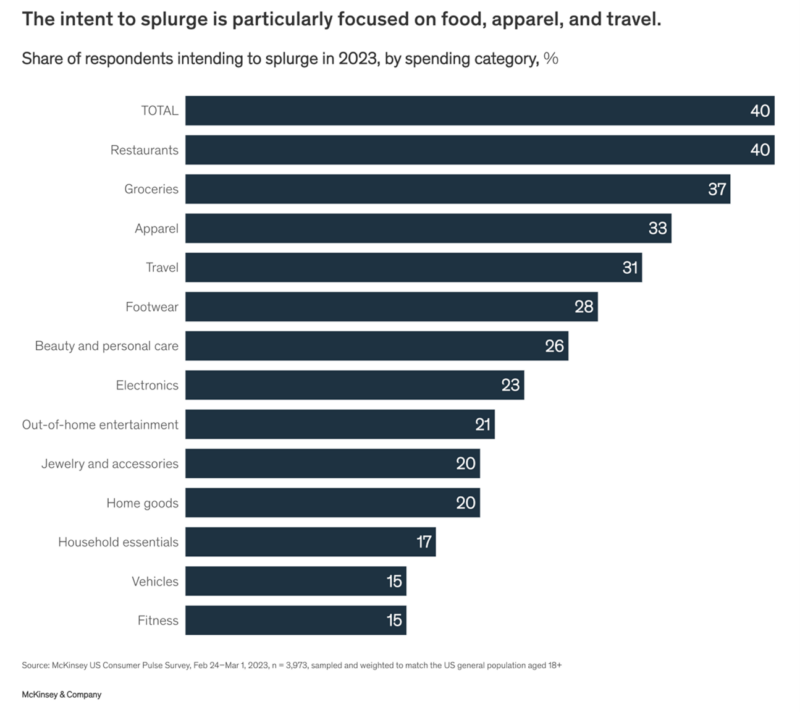

In the early 1980’s, the Baby Boomers were just beginning their saving, spending, and earning cycle. The youngest Boomers were roughly 35 years old just as the stock market and real estate markets began a new and lasting bull market. To be sure, the cost of living today for Millennials versus the early 1980’s is radically different but directionally, the same trends will happen for today’s younger generations but with certain nuances. As an investor in consumer trends and habits, we must analyze today’s trends so we can map back to the brands that should benefit most. Today’s younger generations make more money versus the Boomers, but everything costs much more, our dollars don’t go as far as they once did. A bigger, and more potentially damaging issue we face today; younger adults are not having as many babies as the Boomers or their parents. That’s a long-term issue for many countries. Additionally, younger adults are having kids later in life, having less kids, and therefore spending more time and money on themselves. Experiences are very important to Millennials and Gen-Z, which means the services sector will play a key role in serving this massive group of consumers. Within portfolios, we believe there’s a key allocation to “selective indulgences” that must be made, and our research indicates most portfolios are underweight many of the leading brands that stand to benefit the most. Example: the luxury goods sector. Millennials are the key buyers of aspirational, differentiated luxury products around the world and given their age and future income potential, it leads us to see a very bright future for the brands that make these products. LVMH, Hermes, L’Oreal, Tesla, and Ferrari are just a few brands that appear to have wonderful tailwinds on a secular basis, particularly within Asia. Collectively, Asia has ~2 billion consumers that fall in the Millennial and Gen-Z cohort. They are digitally native, highly brand aware, and are passionate about aspirational brands.

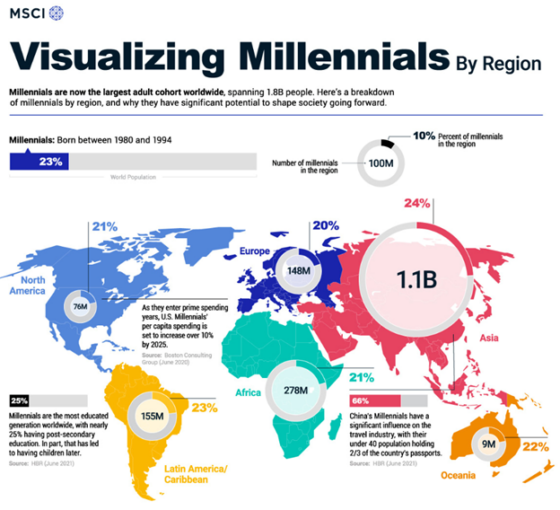

Millennials are the largest population cohort on the planet at roughly 1.8 billion people.

Here’s a great visual showing where this important cohort resides around the world.

As you can see, you cannot ignore how Asian consumers (1.1 billion in size) think and spend if you are investing in the Millennial-focused consumption theme. This cohort loves luxury brands, and they love experiential luxury. Additionally, Millennials are the most educated population cohort which means they have higher lifetime earning potential. As you know, there is a very high correlation between education and earning potential. And when you make more, you spend more, that has not changed from generation to generation.

One concept we think the media will begin focusing on is how U.S. and China relations evolve over time and how it will affect the consumption habits and brand love of consumers. Our view is quite different than consensus currently and we think over time, consensus will move in our direction. Because of poor relations between the two largest countries in the world and because of increased nationalism, we think it will get harder to build a brand in China and some U.S. brands operating in China could see an erosion of brand value as European brands become more popular as well as more Chinese and Asian brands rise in popularity.

To be clear, we think brands like Apple, Starbucks, and Nike have deep roots in Chinese culture but for smaller U.S. brands trying to make inroads, we say caution is advised. The government of China wants its own brands to be the dominant beneficiaries of consumption trends and when you have a centralized government with policies that have zero-tolerance, trends can change over a long period of time. To be clear, this is a slow-moving train but as a capital allocator, we must be mindful of trends like these as we make investments. The important key here: we believe the major net beneficiary of poor U.S. and China relations should be the ex-U.S. brands like Lululemon and leading European Brands like LVMH, Hermes, Ferrari, Kering, Moncler, and others.

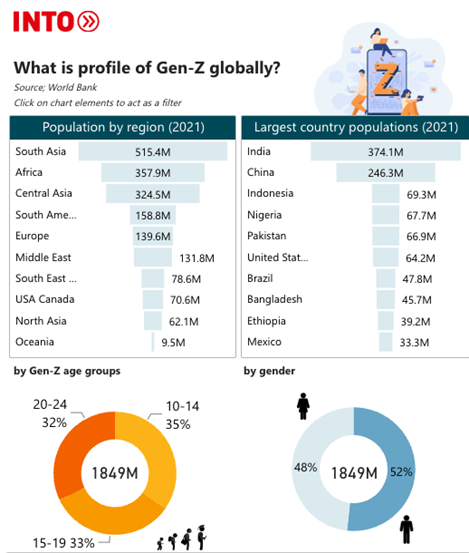

Gen-Z, similar in size and a source of strong future consumption opportunities.

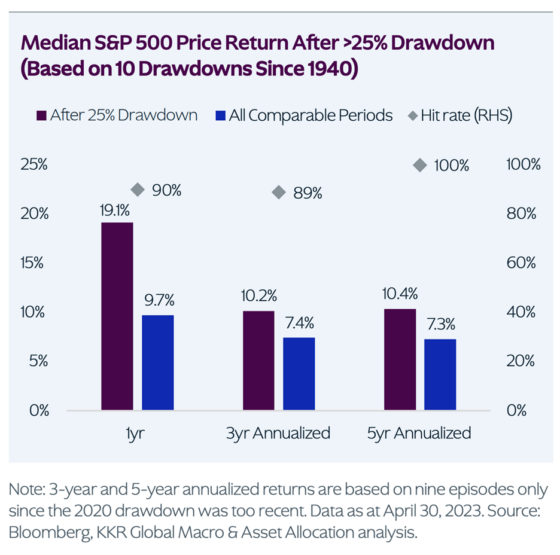

It’s quite rare to have two back-to-back generations larger than the last big population cohort. Baby Boomers and their spending had an outsized effect on the stock market and real estate markets so it’s quite difficult for us to be bearish long-term given the powerful spending tailwinds from these two population groups. No one can predict the future and the business cycle always matters but the moral of the story is this; when you see bouts of weakness, that’s simply an opportunity to build bigger positions in the companies and Brands that serve this important mega trend. People forget, massive secular themes tend to bail investors out even if their investment timing is poor. The greatest businesses serving the largest trends will always have buyers, particularly if/when these stocks go on sale.

Gen-Z, in many ways, will be more productive workers than their Millennial counterparts, partly because their parents were the forgotten generation, Gen-X. Gen-X is the dominant spending cohort in the U.S. today and they generally grew up more independent which makes this group more resilient and resourceful. Gen-Z will benefit from this hard-working cohort as parents. A key attribute of Gen-Z is mobility. This is the first generation that is fully digitally native. The phone is everything. Working Wi-Fi is more important than a working bathroom! They love Snapchat and Facetime. They will be huge consumers of e-commerce. They may not go to college to the degree Millennials did, they see value in alternative sources of education. Experiences matter for this cohort as well which makes the services sector a very important investment opportunity. Good or bad, this generation loves TikTok, Discord, Snap, Instagram, Spotify, Shein, Apple, DoorDash, Reddit, and Vans to name a few.

Again, it’s Asia that investors really need to focus on here. India and China are key regions for consumption opportunities. With global brands setting up more and more manufacturing operations in India, the growth of the Indian consumer is likely one of the most robust opportunities for the long-term. U.S. and European brands are spending large amounts of time and money investing in these countries and attempting to build brand love and loyalty as aggressively as they can. Below, is a great graphic highlighting the Gen-Z population stats around the world.

Bottom line:

Along with Artificial Intelligence, consumption trends for Millennials and Gen-Z offer investors wonderful long-term gain opportunities. Understanding what drives each cohort and which brands they favor is very important to stock selection. Rest assured, we spend a ton of time on these trends and analyzing the brands that matter most.

As we sit today, these brands seem well positioned to capitalize: Apple, Meta, Google, Microsoft, LVMH, Hermes, Ferrari, Spotify, Nestle, L’Oreal, Estee Lauder, Live Nation, Airbnb, Booking.com, Nike, Lululemon, Visa, Mastercard, American Express, McDonalds, Mercado Libre, Amazon, Netflix, Costco, Uber, Target, Starbucks, Home Depot, Coke, Pepsi, Monster Beverage, and Tesla, to name a few. Our portfolios own a large portion of these and with better prices, we would love to own even more.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.